modified business tax nevada due date

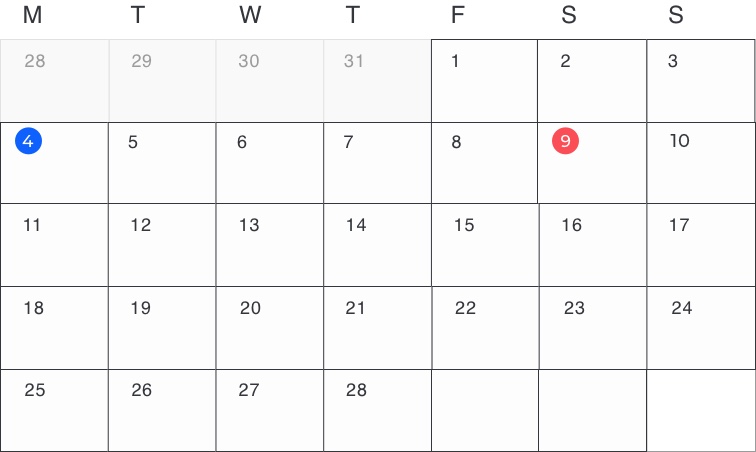

The default dates for submission are April 30 July 31 October 31 and January 31. The result is the amount of penalty that should be.

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

What is the Nevada Modified Business Tax.

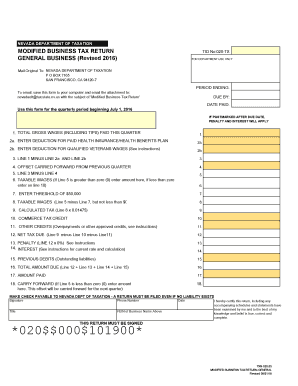

. General business effective july 1 2016 for department use. Ad Download Or Email NV TID 020-TX More Fillable Forms Register and Subscribe Now. General business effective july 1 2015 for department use only.

The due dates are April 30 July 31. Forms and payments must be mailed to the address below. This typically happens in April July October and especially January which coincides with the due dates of monthly quarterly and sometimes annual returns.

The direct or indirect ownership control or possession of 50 or more of the ownership interest. Nevada Business Tax Extension. Determine the number of days the payments is late and multiply the net tax owed by the appropriate rate based on the table below.

12 rows Due Date Extended Due Date. Nevada department of taxation modified business tax return. How to Edit Your Modified business tax return nevada Online Easily and Quickly.

A tax return will still need to be filed by all employers even if the taxable wages are less than 50000 and tax due is 0. Nevada State Commerce Tax return is due between the end of the taxable year July 1st and the due date of the Commerce tax return - August 14th. NEVADA DEPARTMENT OF TAXATION PO BOX 52609 PHOENIX AZ 85072.

The 31st Special Session of the Nevada Legislature enacted Senate Bill 3 which provides for a one-time tax amnesty program for businesses or individuals doing business in. Q2 Apr - Jun July 31. NEVADA DEPARTMENT OF TAXATION MODIFIED BUSINESS TAX RETURN GENERAL BUSINESS Mail Original To.

MODIFIED BUSINESS TAX Nevada Educational Choice Scholarship Program A taxpayer who is required to pay a Modified Business Tax MBT per NRS 363A or NRS 363B may receive a. Prior to July 1 2015 SB475 of the 2013 Legislative. There are three ways to report tax fraud.

Q1 Jan - Mar April 30. Line 6 Taxable wages is the amount that will be used in the calculation of the tax If line 5 is greater than zero this is the taxable wages If line 5 is. Taxable wages x 2 02 the tax due.

Nevada department of taxation modified business tax return. Commerce Tax Credit - Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of MBT tax owed. SALT Report 3089 The Nevada Department of Taxation is advising taxpayers that the September 30 2013 modified business tax returns were printed with the old 62500.

Our state-specific online samples and complete recommendations eliminate. Nevada Modified Business Tax Form Pdf. All forms and tax payments are due by the end of the month following the end of the four-month period.

This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the tax on the Net Proceeds of Minerals imposed pursuant to. When Are the Forms and Tax Payments Due. Follow these steps to get your Modified business tax return nevada edited with accuracy and agility.

Net Tax Due - Line 9 minus Line 10 and enter Net Tax Due. Due to increased returns and. This amount is due and payable by the due date which is the last day of the month following the applicable quarter.

Now working with a Nevada Modified Business Tax Form 2020 requires no more than 5 minutes.

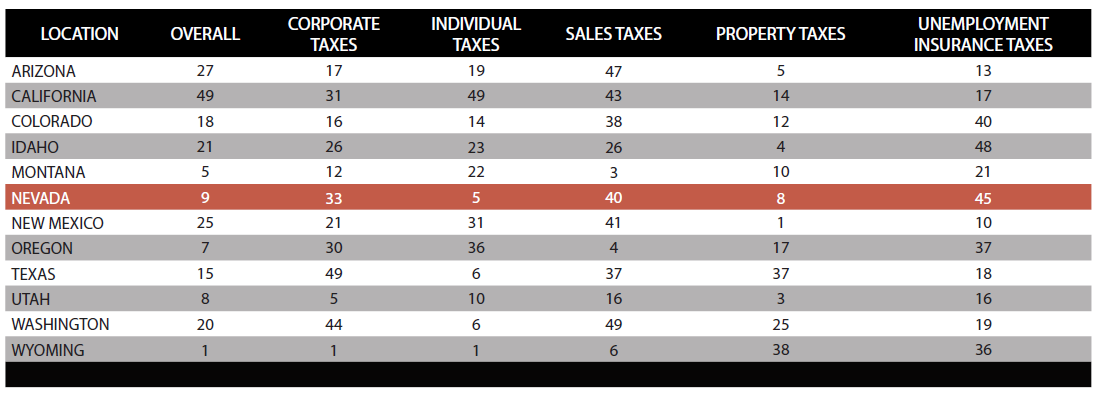

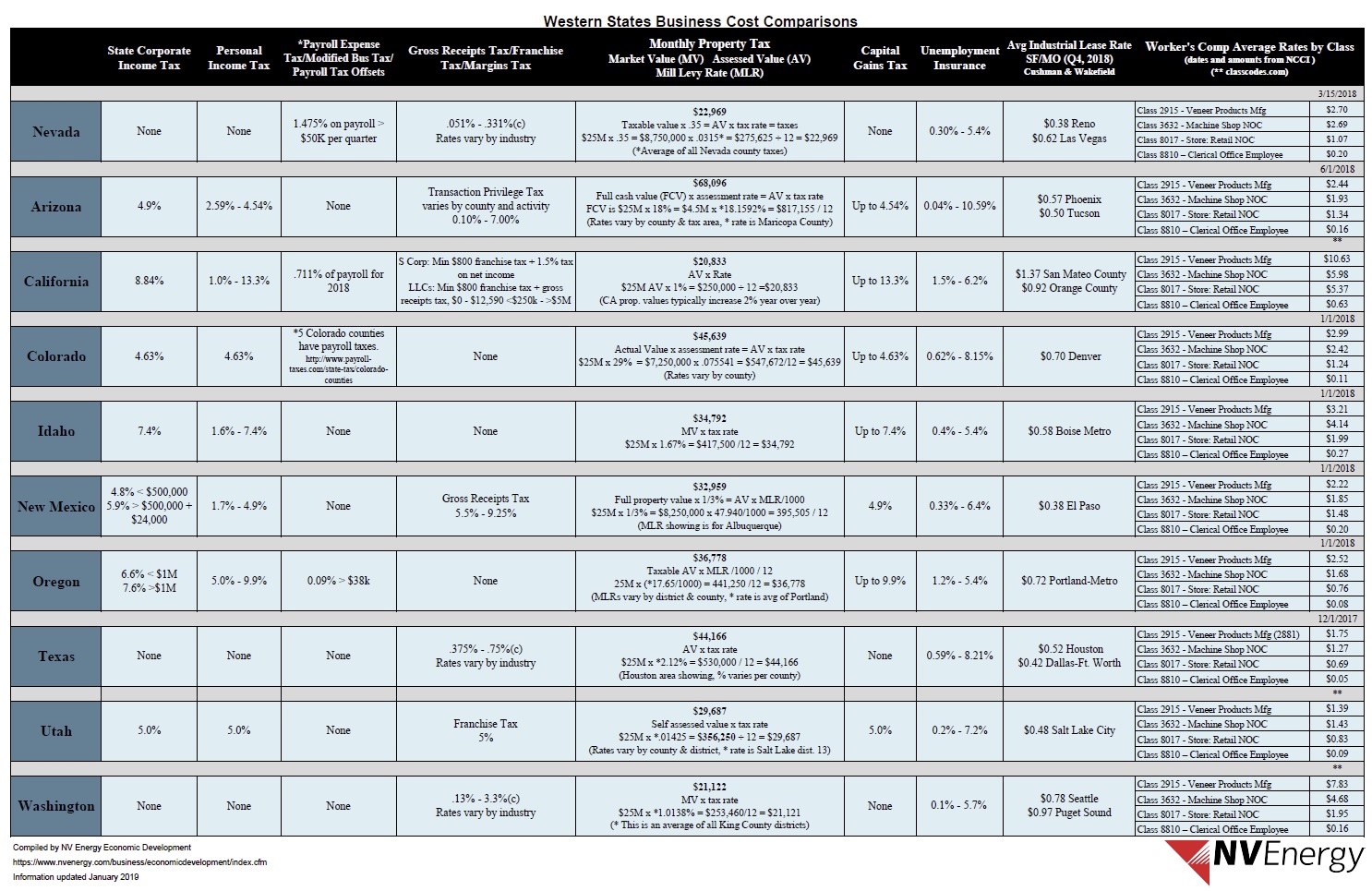

Nevada Taxes Incentives Nv Energy

Don T Throw Away That Notice 1444 Tax Return Irs How To Plan

Nevada Taxes Incentives Nv Energy

Corporate Tax Return Due Date 2019

Llc Tax Calculator Definitive Small Business Tax Estimator

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

Transfer Pricing Case Law And Guidelines From Around The World

Llc Tax Calculator Definitive Small Business Tax Estimator

Llc Tax Calculator Definitive Small Business Tax Estimator

Chapter 14 Formulary Apportionment In Theory And Practice In Corporate Income Taxes Under Pressure

Transfer Pricing Case Law And Guidelines From Around The World

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business