virginia estimated tax payments safe harbor

If you pay 100 of your tax liability for. If you are unable to file by such due dates.

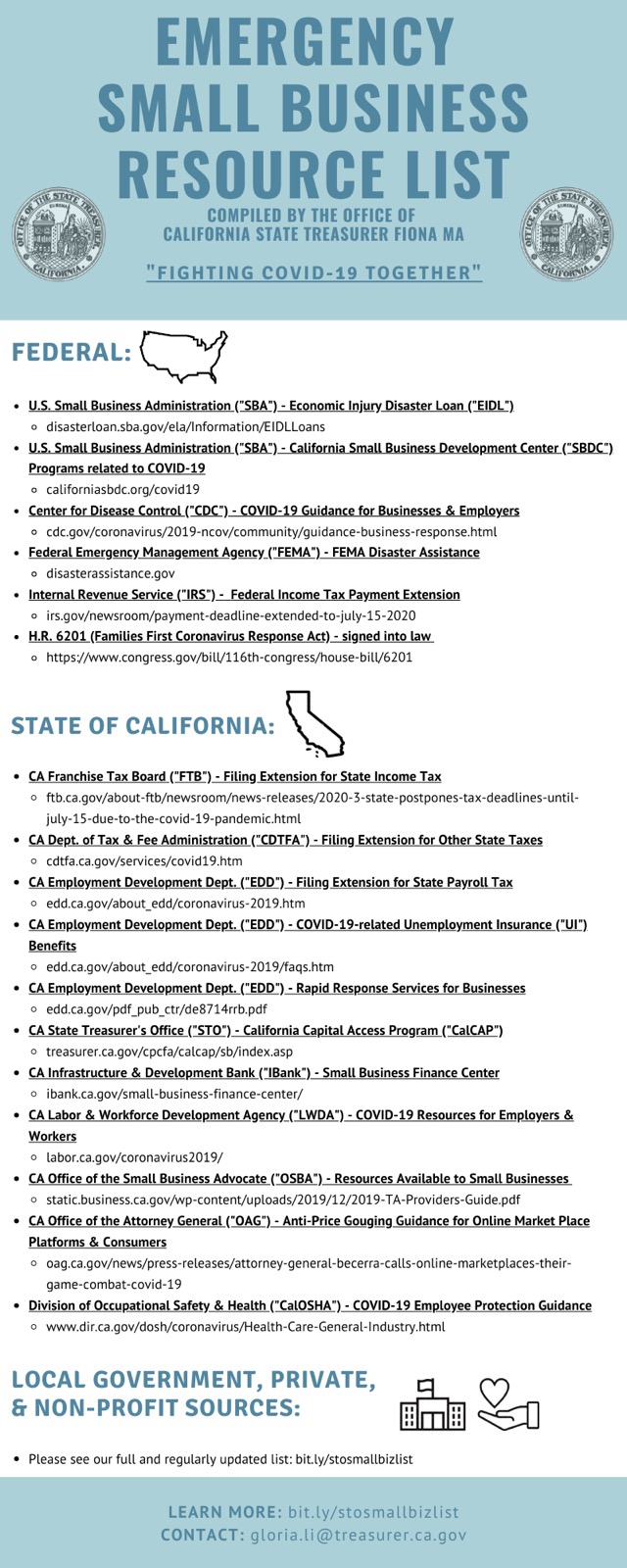

Virginia Begins Requiring Electronic Payment For Certain Individual Taxpayers Miles Stockbridge P C Jdsupra

The fourth and final 2022 estimated tax payment is due January 17 2023.

. Corporate estimated tax payments safe harbor. If you pay 100 of your tax liability for the previous year via estimated quarterly tax payments youre safe. WHEN TO FILE Make estimated payments online or file Form 760ES Payment Voucher 1 by.

The estimated safe harbor rule has three parts. This objective of the safe harbor provision - to provide a predictable escape from any possible penalty liability - would be defeated if penalties for underpayment of estimated. Safe harbor can be applied to estimated taxes giving you some leeway in how much you need to pay.

If your adjusted gross income for the year is over 150000 then you must pay at. And if certain conditions are met your penalty is waived or reduced. Mail the 760-PMT voucher with check or money order payable to Virginia Department of Taxation to.

If you pay 100 of your tax liability for the previous year via estimated quarterly tax payments youre safe. If you expect to owe less than 1000 after subtracting your withholding youre safe. Quarterly estimated tax payments refer to money owed to the IRS to help make payments against the tax liability youre going to file for on April 15 or your extended deadline respectively.

Make tax due estimated tax and extension payments Business Taxes Pay all business taxes including sales and use employer withholding corporate income and other miscellaneous. Virginia Department of Taxation PO. In fact this is one of the exceptions to the penalty for.

Tax due reported on return - 200000 Extension penalty 3 months 2 per month - 12000 Late payment penalty 1 month 6 - 12000 Note. D your expected estimated tax liability exceeds your withholding and tax credits by 150 or less. Pay Online provides complete tax payment information how and when to.

Make tax due estimated tax and extension payments. 90 of the tax liability for the related tax return or 100 of the total tax liability shown your previous years tax return If your AGI was more than 150000 75000 if your filing status is. The safe harbors for corporate estimated tax are both 100.

The estimated safe harbor rule has three parts. Heres the 2022 FPL Safe Harbor formula. As you had no tax liability in Virginia for tax year 2018 you are not required to pay estimated taxes for tax year 2019.

If the employee contribution for self-only coverage meets or is below 10315 then the FPL Safe. A payment of estimated tax on any installment date shall be considered a payment of previous underpayment only to the extent such payment exceeds the installment which would be. Interest applies to any balance of tax.

Virginia safe harbor As. The safest option to avoid an underpayment penalty is to aim for 100 percent of your previous years taxes If your previous years adjusted gross income was more than. If you pay 100 of your tax liability for the previous year via estimated.

12880 x 961 12 10315. The estimated safe harbor rule has three parts. Box 1478 Richmond VA 23218-1478 Include your.

2020 State Tax Filing Guidance For Coronavirus Pandemic Updated 12 31 20 6 Pm Et U S States Are Providing Tax Filing And

Estimated Tax Payments How They Work And When To Pay Them Bankrate

Calculating Paying Quarterly Estimated Taxes For A Small Business In Wi Giersch Group Milwaukee Wi 53202

Quarterly Estimated Tax Payments Who Needs To Pay When And Why

How To Calculate Safe Harbor Estimated Tax Payments

Safe Harbor For Underpaying Estimated Tax H R Block

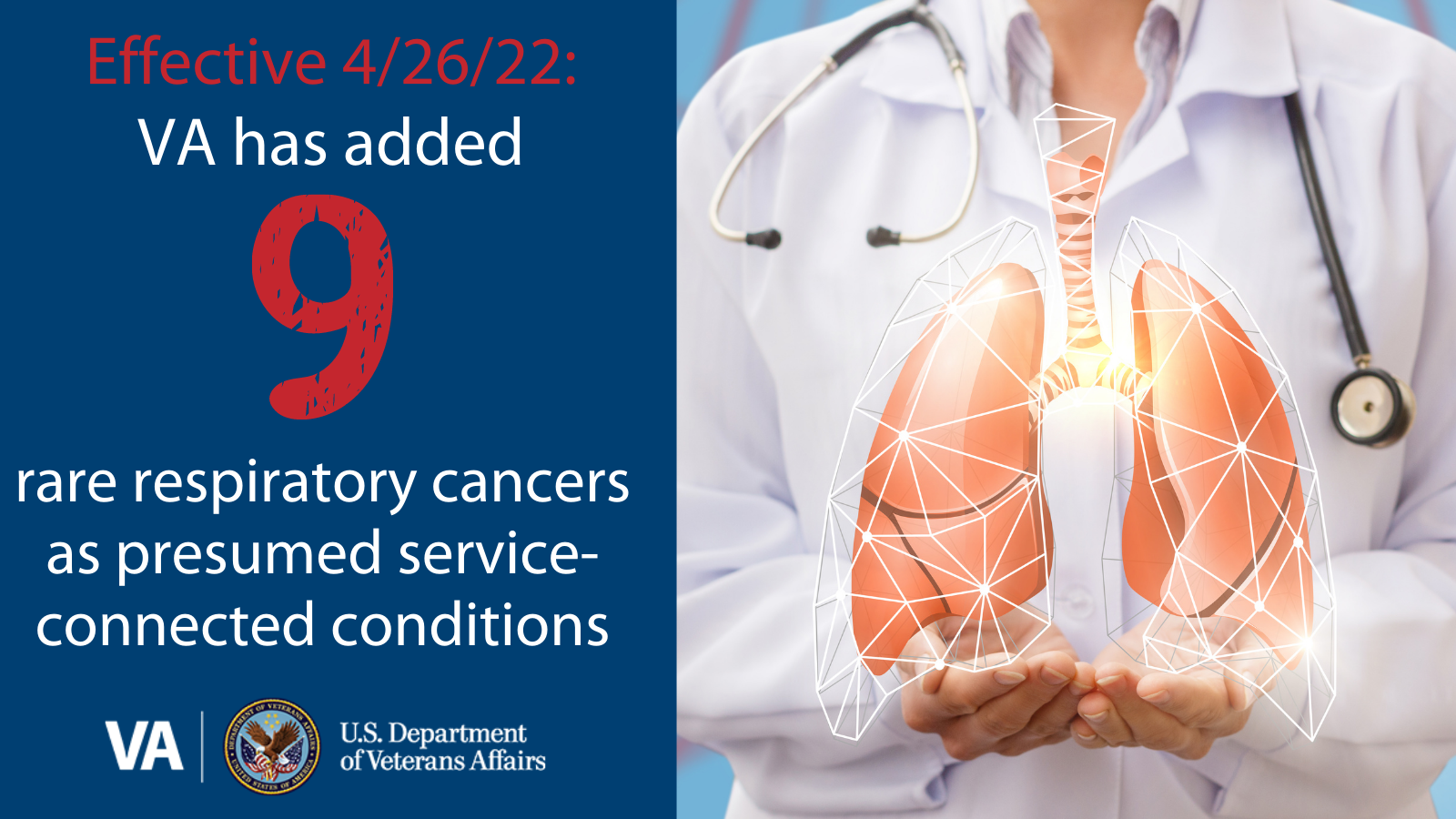

Nine New Cancers Added To The Presumed Service Connected List Related To Particulate Matter Va News

106 Safe Harbor Ln White Stone Va 22578 Mls 2132413 Zillow

State Estimated Taxes Planning Quicken

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

You Need To Pay Your Taxes Quarterly If Marketwatch

Update Virginia Follows Irs Due Date Move To May 17 Cpa

State And Local Tax Advisor April 2021 Our Insights Plante Moran

20 Things To Know Before Moving To Virginia

Tax Planning Northern Va Tax Preparation Accountant Dc Stitely Karstetter Stitely Karstetter Cpas

5487 Safe Harbor Ct Fairfax Va 22032 Mls Vafx2010276 Redfin

Safe Harbor Requirements For Estimated Tax Payments Miller Consulting Group

How To Pay Federal Estimated Taxes Online To The Irs In 2022